estate tax changes build back better

Restaurants In Matthews Nc That Deliver. Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law.

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

In late October the House Rules Committee released a revised.

. The CBO estimates the bill will cost almost 17 trillion and add 367 billion to the federal deficit over 10 years. Lowering the gift and estate tax exemptions seems a lock. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million. Larson Brown PA.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Opry Mills Breakfast Restaurants. December 6 2021.

The proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan. Lowering the gift and estate tax exemptions seems a lock. The House-passed version of the Build Back Better Act changes the base erosion provisions of Section 59A by gradually increasing the applicable percentage from 10 to 125.

One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117. House Rules Committee releases updated version of the Build Back Better Act initial impressions Substantial number of changes to the tax-related provisions of the bill. The House Ways and Means Committee approving the tax provisions in President Bidens Build Back Better Act.

3 version introduced an increase to the cap with a slightly higher. That was Step 1. Under current law the estate and gift tax exemption is 117 million per person.

Adding in 207 billion of nonscored revenue that is estimated to. Our tax expert weighs in. Revised Build Back Better Bill Excludes Major Estate Tax Proposals.

Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA. Notable aspects of the Biden framework for the Build Back Better Act that will affect estate planning include.

On September 13 2021 the House Ways and Means Committee released a proposed tax bill House proposal as part of the Biden administrations Build Back Better Act The segments. These proposals are currently under. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

The exclusion amount is for 2022 is 1206. Day Pitney Generations Newsletter. Ad Get free estate planning strategies.

Step 2 would be to forgive the note immediately before passage of an estate tax exemption balance reduction or whenever the donor was ready to do so. Economic Effects of the Updated House Build Back Better Act For purposes of estimating the bills impact on federal budget deficits interest payments and resulting. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Dont leave your 500K legacy to the government. 5376 would revise the estate and gift tax and treatment of trusts. Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in.

The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

Estate Tax Changes Build Back Better. You can gift up to the exemption amount during life or at death or some combination thereof. Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov.

Estate and Gift Tax Exemptions The Biden framework does not.

Building Back Together Buildingback Us Twitter

Managing Your Personal Taxes 2021 22 A Canadian Perspective Ey Canada

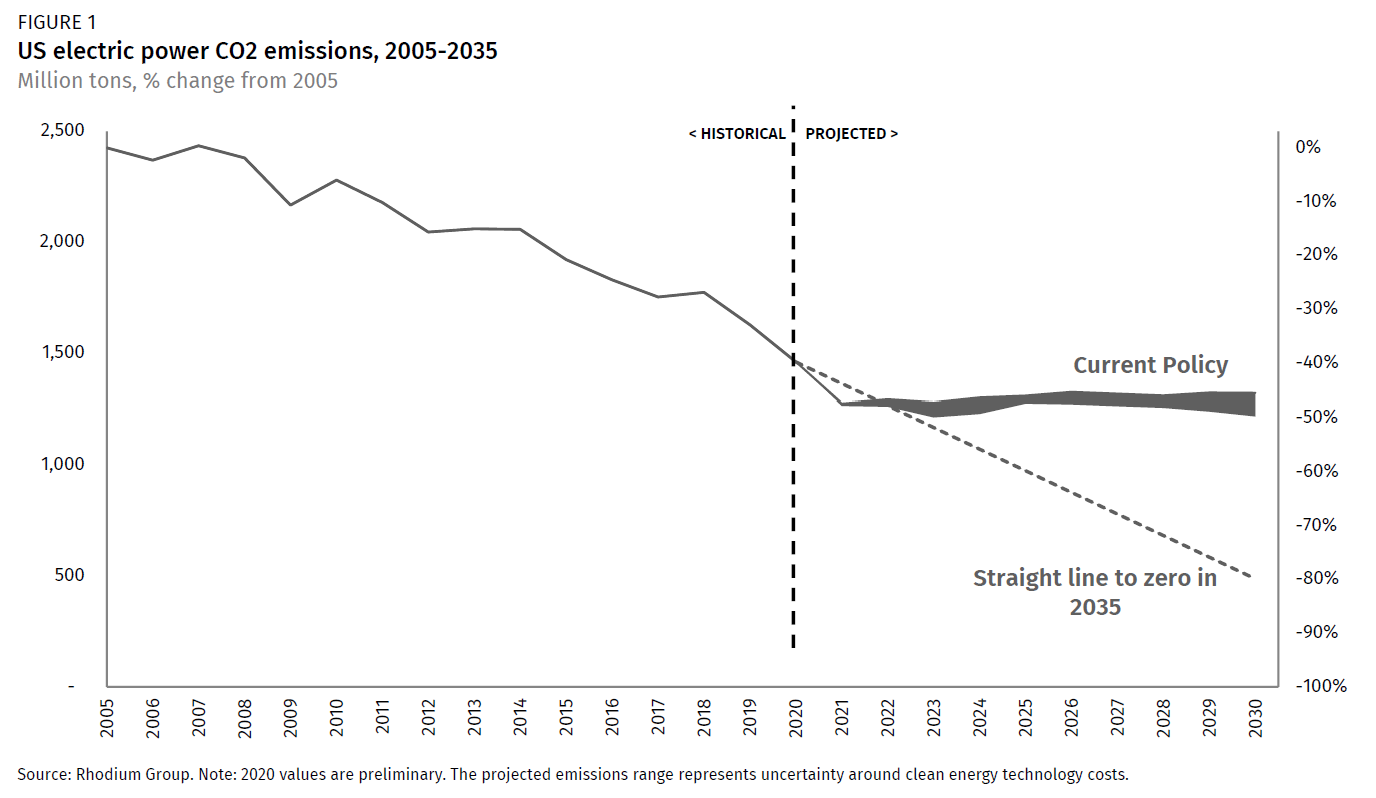

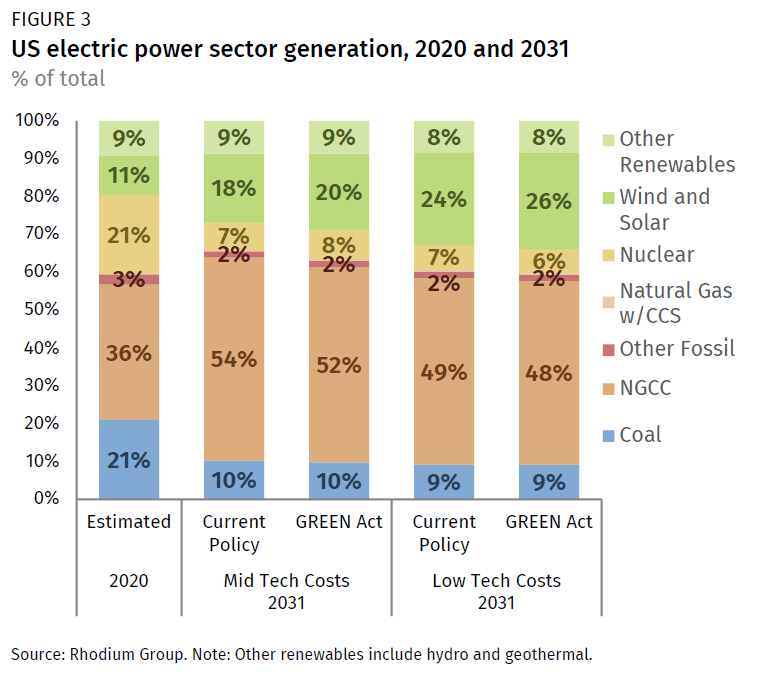

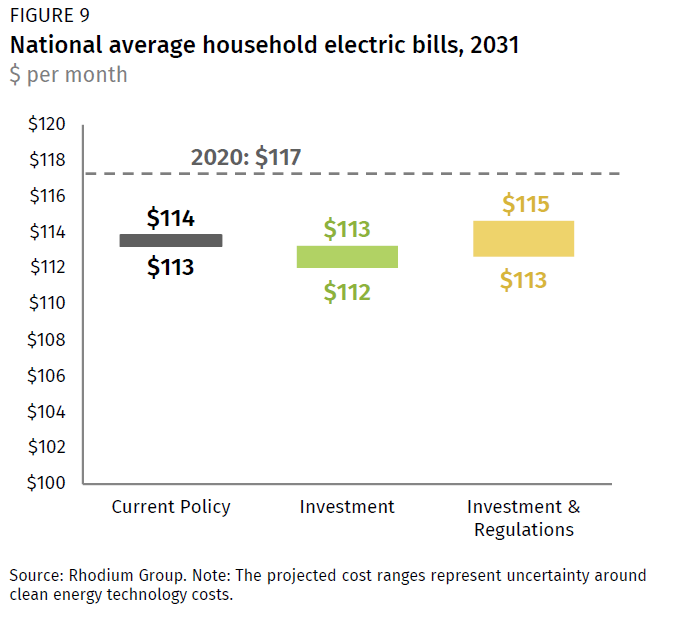

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Time To Change Your Estate Plan Again

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

Tax Measures Supplementary Information Budget 2022

:max_bytes(150000):strip_icc()/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

Time To Change Your Estate Plan Again

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

Politifact Fact Checking Whether Biden S Build Back Better Would Be Largest Expansion Of Welfare In 60 Years