sales tax on leased cars in arizona

If you buy a new car from a dealer in Arizona and plan to register the car in the state you will be charged sales tax on the amount equal to the price of the new car minus the trade-in value of. Items are leased with intent to purchase at the end of the lease for a nominal amount.

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

In Arizona the sales tax for cars is 56 but some counties charge an additional 07.

. Arizona exempts lessors of motor vehicles from the transaction privilege tax on their income if they are subject to the motor carrier fee. For vehicles that are being rented or leased see see taxation of leases and rentals. The most common method is to tax monthly lease payments at the local sales tax rate.

For nonresidents from all other states with a higher state tax rate than Arizonas 56 percent TPT rate and allow credit against their state excise taxes for the state tax paid in Arizona the state. All used and new car purchases in Arizona have the statewide sales tax of 56 applied to them. County or local sales tax is specific.

How Much Does It Cost To Lease A Car Credit Karma What Is A Jaguar Lease Buyout Chandler Az Jaguar Chandler Is A Short Term Car Lease A Good Idea Credit Karma. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. Bullhead City AZ Sales Tax Rate.

But using the above example say the sales tax was 8 percent. In order to qualify for the exemption the. It was registered to my second home in California.

In most states tax will be due on a capital. General sales tax in my city is 825 including state and county as well. Lease Payment Before Taxes x 1 State Sales Tax The 1.

Local tax rates range from 0 to 56 with an. The best way to calculate the amount of sales tax on your lease buyout is to look at the original lease paperwork where you can find a breakdown of the taxes. The math would be the following.

There is no county use tax in Arizona The bill of sale must include the dealers zip code and the amount of sales tax or excise tax paid. Unfortunately the price isnt capped there. Motor Vehicles TAXABLE In the state of Arizona any rentals for which lasted a maximum of 180 days are considered to.

I registered it to my home in Arizona several days before the annual California registration. Arizona collects a 66 state sales tax rate on the purchase of all vehicles. Groceries and prescription drugs are exempt from the Arizona sales tax.

Casa Grande AZ Sales Tax Rate. Some cities can charge up to 25 on top of that. I leased a car in California.

If you lease from CA for example they will calculate your first payment based. Most states tax based on the. If your vehicle is powered only by liquefied petroleum gas LPG propane natural gas CNGLNG a blend of 70-percent alternative fuel and 30-percent petroleum-based fuel not available in.

This means you only pay tax on the part of the car you lease not the entire value of the car. The sales tax varies by state. To learn more see a full list of taxable and tax-exempt items in Arizona.

The current statewide sales tax in Arizona is 56. However there may be an extra local or county sales tax added onto the base 56 state tax. The true object of the transaction is a sale.

If the out-of-state tax that you paid is less than. I guess my question has more to do with how AZ taxes lease payments. However the total tax may.

Buckeye AZ Sales Tax Rate. Step 1- Know Specific Tax Laws. Where you lease the vehicle from is irrelevant unless you pick a state that charges all taxes up front.

Avondale AZ Sales Tax Rate.

Sales Tax Transaction Privilege Tax Queen Creek Az

Is Buying A Car Tax Deductible Lendingtree

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

How Much Is A Tesla Lease In 2022 Electrek

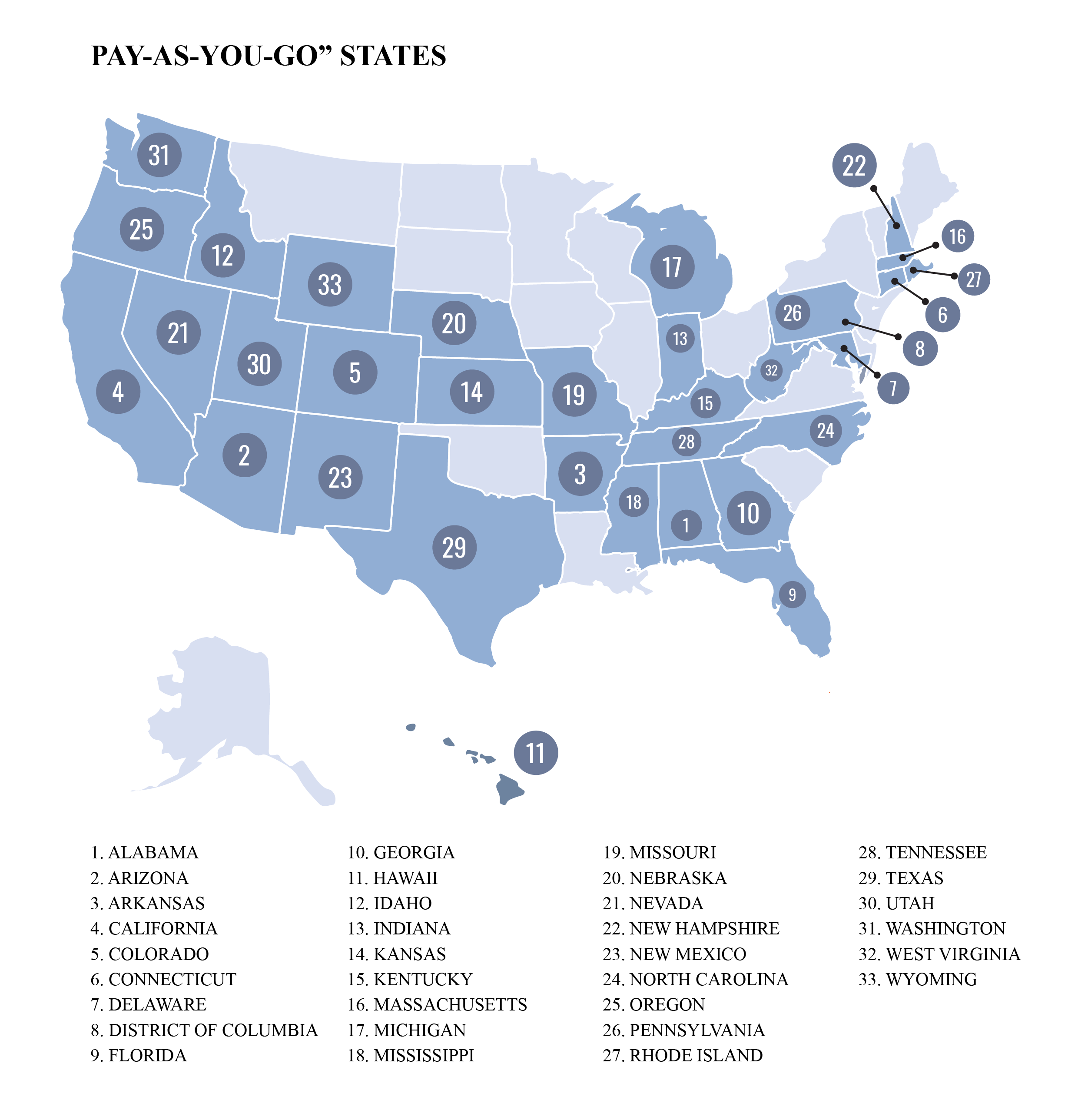

Modernizing Rental Car And Peer To Peer Car Sharing Taxes

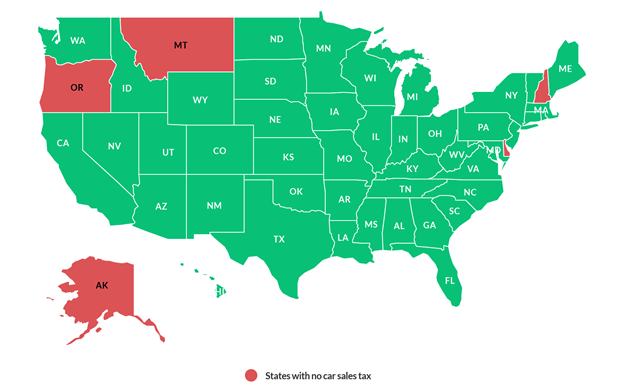

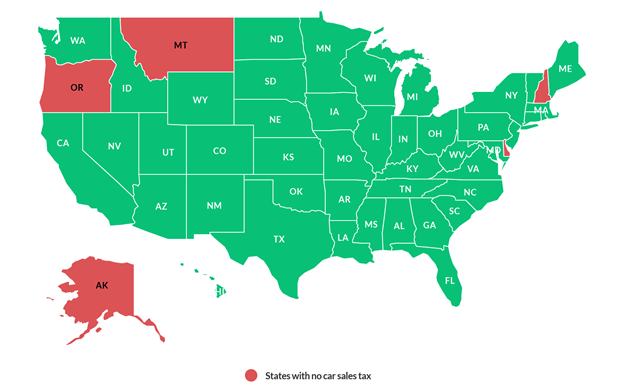

What S The Car Sales Tax In Each State Find The Best Car Price

Used 2018 Audi S5 Sportback For Sale In Phoenix Az With Photos Cargurus

If I Buy A Car In Another State Where Do I Pay Sales Tax

Tesla Lease Guide Prices Estimated Payments Faqs And More Electrek

Why You May Want To Lease A Car For Your Teenager Consumer Reports

Calculate Whether To Lease Or Buy A Car State Farm

Best Lease Deals Specials Lease A Car With Edmunds

Car Tax By State Usa Manual Car Sales Tax Calculator

Phoenix Car Rental For Your Car Van And Suv Rental Needs

Do Auto Lease Payments Include Sales Tax

Bill Luke Alfa Romeo Luxury Auto Dealer Service Center Serving Phoenix

Subaru Impreza Sales Lease Specials Walnut Creek Ca Diablo Subaru Of Walnut Creek

Are You Cash Negative At The Inception Of A Bhph Deal Due To Sales Tax Lhph Capital

What S The Car Sales Tax In Each State Find The Best Car Price